H1b paycheck calculator

Next select the Filing Status drop down menu and choose which option applies to you. First enter your Gross Salary amount where shown.

Chances Of H1b Approval After Lottery 2021 22 Denial Rfe Steps Usa

Answer 1 of 3.

. Texas Unemployment Insurance UI is paid on the first 9000 in wages you pay each employee every calendar year. The one I use is below. Make Your Payroll Effortless and Focus on What really Matters.

If you contribute more money to accounts like these your take-home pay will be less but you may still save on taxes. These accounts take pre-tax money which means the money comes out of your. The more information you add to the LCA search the better result will appear.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. Subtract any deductions and payroll taxes from the gross pay to get net pay. How does it work.

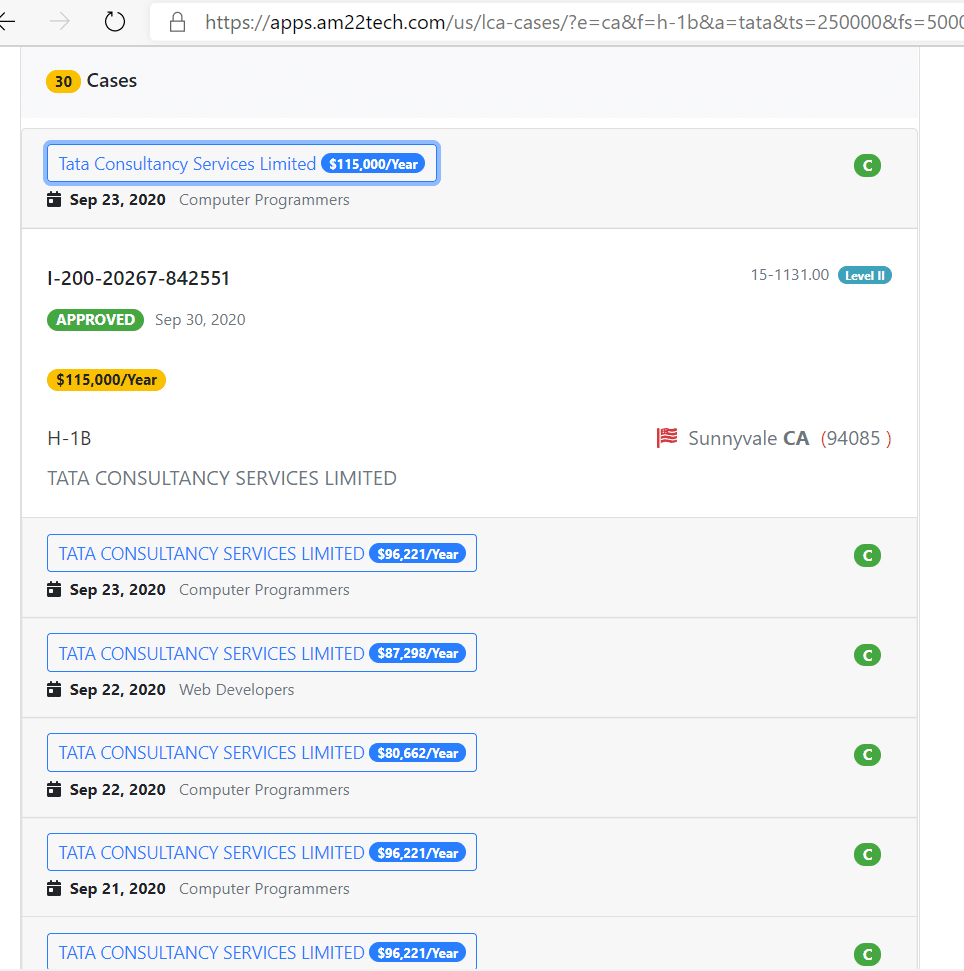

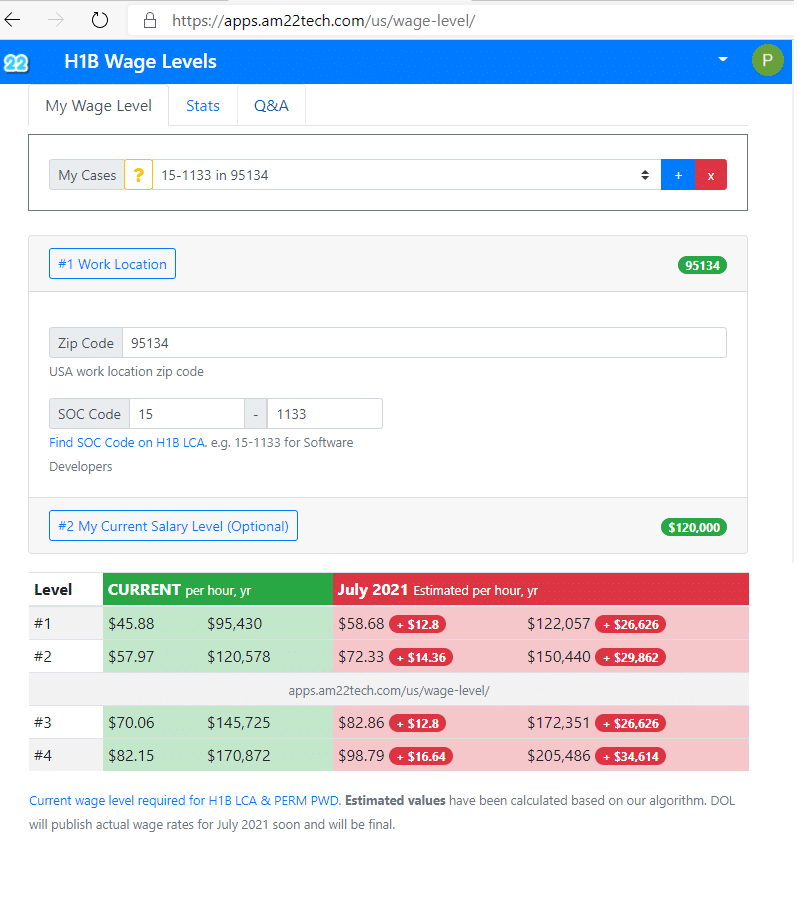

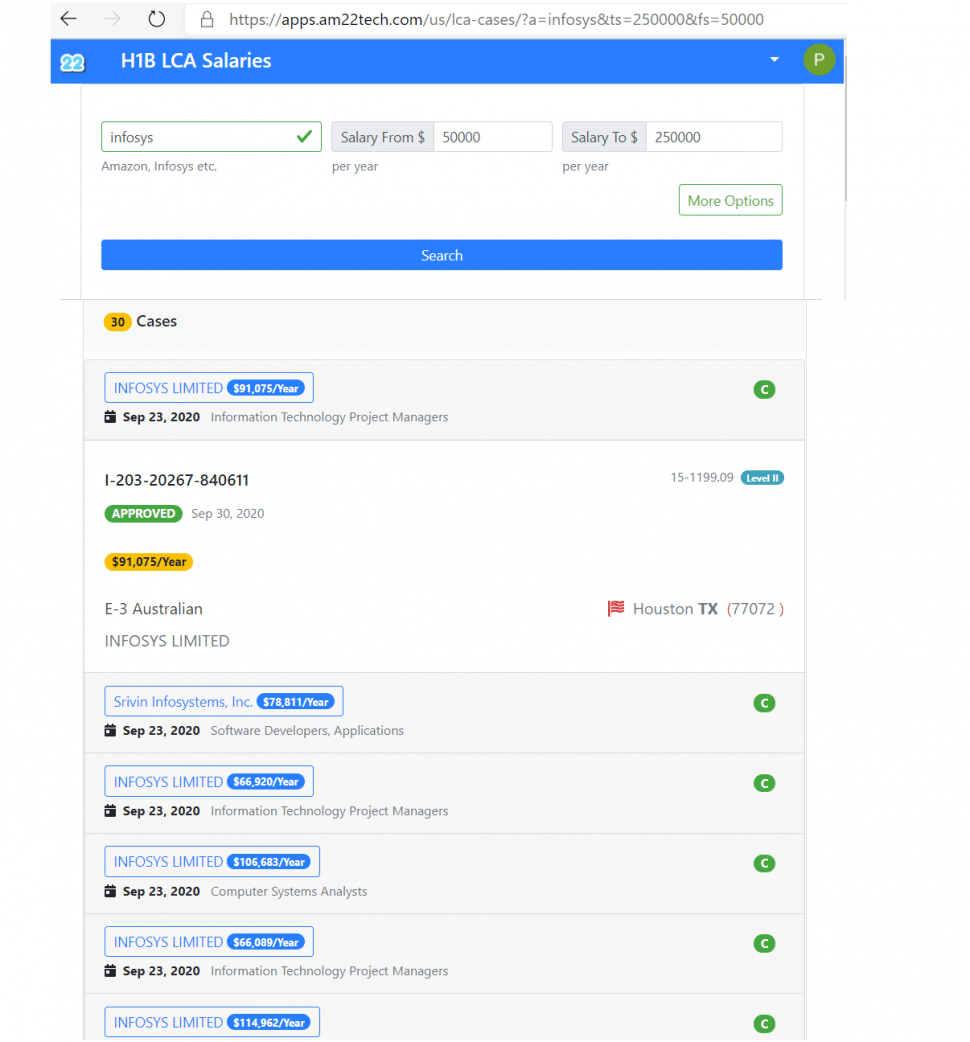

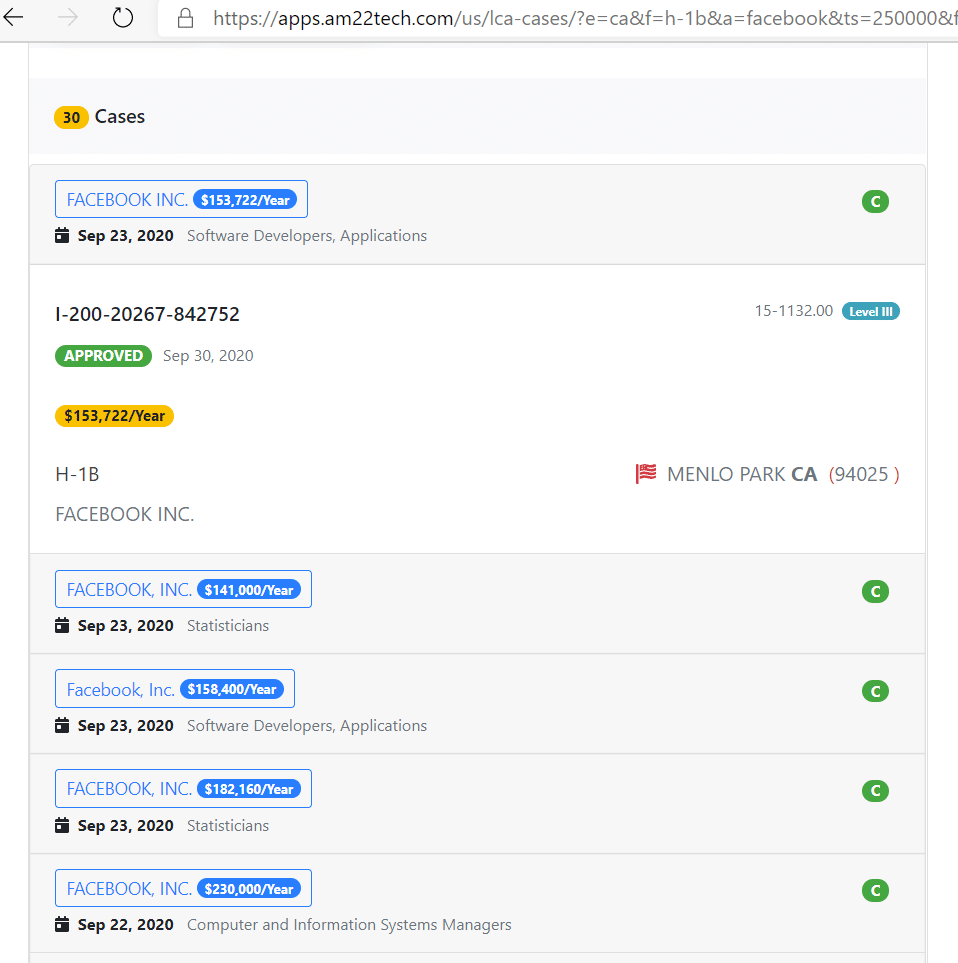

You can find your own H1B H1-B1 or E-3 Australian visa LCA if you can enter your work location zip code employer name and your job title. There are lot of online sites which help you with this. Calculating paychecks and need some help.

Besides FICA taxes you will see federal income taxes are also taken out of your paychecks. This money goes to the IRS where it is counted toward your annual income taxes. As an H1B worker in the US you can expect to pay between 20-40 of your wages in federal and state and local taxes depending on your income level.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Your tax rate is calculated using several factors and can change each yearthe minimum tax rate is 036 and the maximum rate is 636 in 2019. This number is the gross pay per pay period.

Find My LCA. Arizona has a progressive tax system with varying rates depending on your income level. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

How much someone might pay in federal income taxes varies from person to person and depends on factors such as your salary marital status and number of dependents. The PaycheckCity salary calculator will do the calculating for you. We keep our databases updated daily with Latest LCA Filings from Department of Labor.

Next select the State drop down menu and. Federal income tax Federal payroll tax aka. Peach State residents who make more money can.

Calculate your Arizona net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Arizona paycheck calculator. Check out the Texas Workforce Commissions website to find your current tax rate. Only difference between F1OPT and.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Salary Paycheck and Payroll Calculator.

Use the paycheck calculator to figure out how much to put. Overview of Arizona Taxes. Overview of Georgia Taxes.

There are four tax brackets that range from 259 and 450. Welcome to H1B Salary Online. What is the Fee Calculator.

Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. This website indexed 10 Million Labor Condition PERM Applications filed from 2001 through 2019. The test is applied on a calendar year-by-calendar year basis January 1 December 31.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and. FICA State income tax depending on where you live Local income tax depending on where you live. Another thing you can do is put more of your salary in accounts like a 401k HSA or FSA.

Search For H1B Visa Salaries. Prevailing Wage Level Calculator for H-1B H-1B1 E-3 and H-2B Visas and PERM Labor Certification. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Generally an alien in H-1B status hereafter referred to as H-1B alien will be treated as a US. Under certain circumstances an H-1B alien who fails to. If you are filing taxes and are married you have the option to file your taxes along with your partner.

Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. These taxes will include. An H1B worker in New York and employed by JP Morgan Chase can locate his LCA using this search criteria.

For forms not listed please refer to the Form Instructions or our Filing Fees page. Dont want to calculate this by hand. Switch to Arizona hourly calculator.

How to calculate taxes taken out of a paycheck. Using the United States Tax Calculator is fairly simple. H1BSalaryOnline provides the most accurate and authentic H-1B Visa Salary Information directly from the Disclosure Data.

Ad Compare 5 Best Payroll Services Find the Best Rates. Get the Paycheck Tools your competitors are already using - Start Now. Resident for federal income tax purposes if he or she meets the Substantial Presence Test.

Salary Paycheck Calculator Payroll Calculator Paycheck City It helps you calculate your net salary based on your location.

Find H1b Salaries Lca Employers Compare Estimate Usa

H1b Lottery Chances What H 1b Lottery Results Say About Odds 2022

Guide To Uscis H1b Processing Times Regular Premium 2022

H1b Salary Comparably

California Paycheck Calculator Smartasset

Uscis Withdraws Wage Levels Based H1b Lottery Rule Why 2022

H1b Salaries When To Trust The Data And When To Ask More Questions

C 5yvdlp1cd1wm

Ultimate Guide To H1b Fee How Much Who Pays 2022

California Paycheck Calculator Smartasset

Find H1b Salaries Lca Employers Compare Estimate Usa

Am22tech Usa Australia Canada Immigration Visa Money Green Card Application Visa Academic Essay Writing

Find H1b Salaries Lca Employers Compare Estimate Usa

Find H1b Salaries Lca Employers Compare Estimate Usa

Find H1b Salaries Lca Employers Compare Estimate Usa

H 1b Visa Transfer Process Documents Fees 2022

The O1 Visas An Alternative To H1b For Stem Opts Visa Peer Group Client Relationship